In Practice : Information Disclosure at IDB Invest

Ishita Petkar and Jocelyn Medallo

On May 23, 2018 the private sector lending arm of the Inter-American Development Bank, IDB Invest (formerly, the Inter-American Investment Corporation), opened its draft Access to Information Policy for public consultation. Replacing the Bank’s current Disclosure of Information Policy, the new draft policy will be “governed by the principle of maximizing access to information”, a fundamental human right.

This process can be esoteric. Why is it important to pay attention to the information disclosure policies and practices of a development bank?

Having early access to information can mean the difference between a community learning about a development project when the bulldozers arrive, and a community engaging with investors to co-design a project that avoids harm and creates real benefits. In practice, the right to access information goes far beyond simple information disclosure — it ensures that communities are equipped with the necessary information to substantively engage in the development processes that will ultimately shape their lives.

Over the past two years, International Accountability Project (IAP) and our partners have monitored IDB Invest’s online disclosure practices to better understand and analyze what information is being disclosed about projects, when it is being shared, and ultimately, how accessible the information is for communities — the purported beneficiaries of development investments. Our previous analyses of projects disclosed between March 2015 and April 2017 found that under the current policy, IDB Invest fell considerably short of international best practice, resulting in significant gaps in information disclosure and barriers to access to information for communities.

Our Methodology

Our objective is straightforward: to assess the information made available online for potentially affected communities to access, and to share our assessment with IDB Invest in the spirit of contributing to a more robust and people-centered Access to Information Policy and practice.

As part of the Early Warning System initiative, our updated analysis tracks the information disclosed on the IDB Invest website for 98 projects proposed between April 1, 2017 and July 31, 2018. We monitored IDB Invest’s disclosure practices by reviewing and assessing the information available on each project’s webpage, as of August 2018, based on criteria aimed at maximizing community access to information.

Specifically, we tracked:

- The number of days available for communities to access information before an investment decision is made (also known as the Board date);

- Whether a summary or overview of the potential environmental and social harms that might result from the proposed project was disclosed;

- Whether IDB Invest clearly indicated which environmental and social policies were applicable to a project and which corresponding safeguard policies were triggered;

- Whether documents such as environmental and social impact assessments (EIAs), and environmental social action plans (ESAPs) were disclosed;

- Whether documents informing communities about how to engage with a project, such as stakeholder engagement plans and information on consultation dates and locations, were disclosed;

- Whether IDB Invest provided contact information for their client and / or team leads;

- Whether information on IDB Invest’s accountability mechanism, the Independent Consultation and Investigation Mechanism (MICI), was provided; and

- Whether any project documents were readily available in languages other than English.

We evaluated this criteria based on the principle of early access to information. Communities possess local expertise that can better the design of a potential project, anticipate and mitigate adverse impacts, and ensure that projects achieve positive impacts that further their development priorities. Besides — communities have the right to know and to be meaningfully consulted before any investment decision is made, and the right to remedy, should they suffer harms resulting from projects undertaken.

Correspondingly, our analysis primarily focuses on the information communities should expect to access when a project is still in its proposed stage. [1]

Our findings only address information disclosed through IDB Invest’s primary medium of communication — its website. While outside the scope of our analysis, this is already a significant limitation to the accessibility of the information disclosed. Many of the communities affected by the Bank’s investments do not have ready access to computers or the internet. In order to meaningfully fulfill the right to information, IDB Invest must take steps to ensure that information reaches communities potentially impacted by its projects through means accessible to them, before a project is considered for investment.

How does IDB Invest’s disclosure practice measure up?

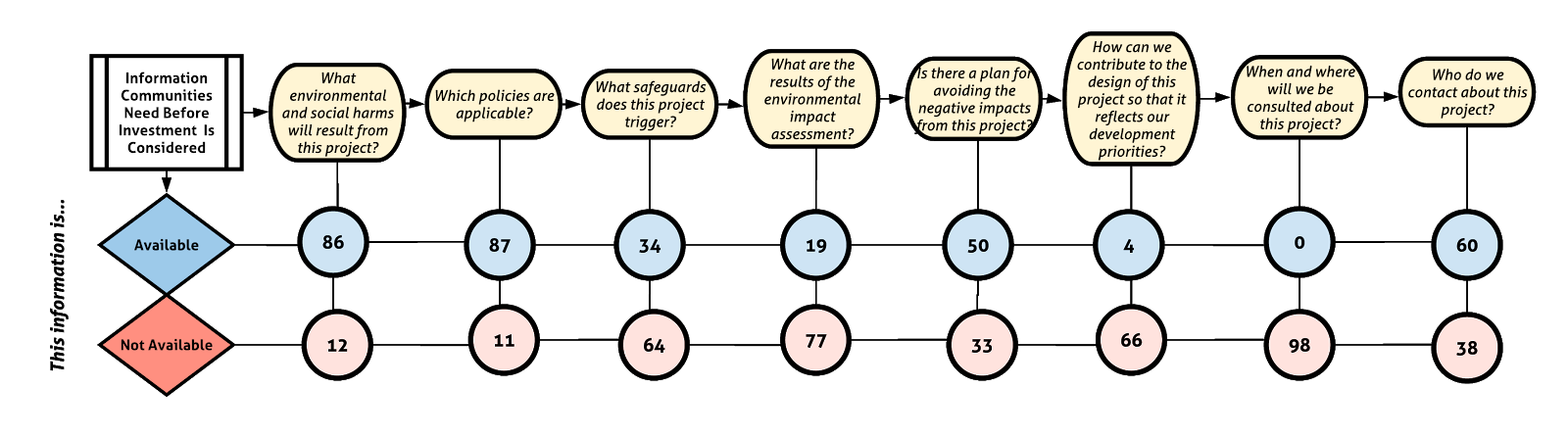

Let’s take a closer look at how many of IDB Invest’s project webpages include the information communities need:

Improvements in IDB Invest’s disclosure practice

Let’s start with what has improved since our last analysis. For projects proposed between April 1, 2017 and July 31, 2018, IDB Invest has improved its disclosure practices in three main areas:

First, IDB Invest is disclosing more information about which environmental and social safeguards apply to a project — albeit marginally. In this dataset, only 34% of projects included information on safeguards, however progress has been made when contrasted with the 5% disclosed within the scope of our previous analysis.

Second, in this sample, information about the Independent Consultation and Investigation Mechanism (MICI) was disclosed on the project webpages for 100% of the projects analyzed, a marked improvement from our previous analysis where none of the projects included this information.

Third, IDB Invest also disclosed project contact information (either for IDB Invest project leads or the client company) for 61% of the projectsenabling communities to follow-up for additional information, as opposed to only 2% of projects proposed between March 1, 2015 and April 1, 2017.

However, although outside the scope of our analysis, we were disappointed to note that IDB Invest’s new website was launched before the end of the consultation period for the draft Access to Information Policy, despite the policy’s significant bearing on the website’s features. Crucially, the new website fails to include information on the MICI for a single project. We hope this oversight is corrected immediately, so that communities are aware of their options in fulfilling their right to remedy. IDB Invest should also offer stakeholders an opportunity to provide feedback on their website, and incorporate the necessary changes resulting from comments submitted during the consultation period.

Remaining gaps and opportunities to increase access to information

These improvements signal that IDB Invest is moving towards disclosure practices that are more open and transparent. However, IDB Invest can still do more to ensure that communities have safe, timely and accessible information early in the lifecycle of a project. Overall, the quality of information being disclosed by IDB Invest is inconsistent and falls short of fulfilling communities’ right to access information. Let’s take a closer look.

Disclosure of environmental and social risks and applicable safeguard policies and entitlements

Although potential environmental and social harms were summarized and relevant policies identified for 87% of projects in our dataset, IDB Invest still falls short in providing specific details about these risks and what entitlements apply to affected communities. Only 34% of projects analyzed identified the safeguards triggered, and only 19% disclosed environmental and social impact assessments. Only 2% of the projects indicated that an environmental and social impact assessment would be produced in the future, and none indicated that such an assessment was inapplicable to the project in question.

This is unacceptable. For a community seeking to understand the potentially life-altering impacts of a project, early access to this information is critical, regardless of risk category. It seems obvious that communities should have the opportunity to fully understand the impacts of a project, analyze the assessments produced within their own rubric of local expertise, understand which safeguards are considered applicable by the Bank, provide recommendations that often highlight overlooked complexities, and suggest alternatives that better the overall project design. Providing access to this information after an investment has already been approved is counter-productive, and does not afford communities meaningful access to information.

Similarly, in our dataset, only 51% of projects disclosed ESAPs for community consideration, and 8% slated ESAPs to be created in the future. Only 7% stated that an ESAP was not required for the project in question. Again, isn’t it obvious that communities should know that IDB Invest, as a development institution, has a plan in place for avoiding and mitigating negative impacts from a proposed project? Accordingly, ESAPs should be produced and disclosed prior to a project being approved, so that communities have an opportunity to identify any oversights and provide contributions that strengthen the action plan.

If Bank policy does not require an ESAP or other environmental and social documents to be created, IDB Invest should ensure that the rationale for their inapplicability is clearly outlined.

Information on how to substantively engage in a project’s design and implementation

IDB Invest’s disclosure practice is weakest on providing access to information on stakeholder engagement — the details of how and when a community member can engage with a project. Fulfilling the right to access information goes hand-in-hand with meaningful consultation and stakeholder engagement to ensure projects actually better the lives of those they affect. From the experience of IAP and our partners, inadequate consultation can result in or exacerbate existing environmental and human rights risks, resulting in social conflict and grievances. In our dataset, only 4% of the projects (or, an astounding 4 out of 98) disclosed plans for stakeholder engagement. 26% stated that these documents would be created in the future, while only 2% indicated that these plans were not required. None of the projects included information on the dates or locations for community consultation. Without access to this information, how are communities expected to meaningfully participate? And, without access to documents on the environmental and social impacts, action plans, and policies in place, how can communities be truly informed participants in consultations?

Notice before investment decisions are made and accessibility of information disclosed

Our points above are predicated on the recognition that in addition to early access to information, communities require sufficient time to understand and evaluate project information, in order for their rights to be meaningfully fulfilled.

As the interactive map illustrates below, the longest period of notice communities (theoretically) receive before an investment decision is made averages 152 days for projects that are considered high risk, or Category A [2]. However, this accounts for a total of only 8% of the projects in our sample. For Category B projects, which account for 45% of the total analyzed, the average period between when information on a project is first posted on IDB Invest’s website and when the project is considered for approval is 54 days. This means that in addition to the barriers detailed above in accessing specific documents, a community has a little less than two months to translate and understand the information disclosed, organize themselves, evaluate the project’s impacts, and propose recommendations based on their expertise to decision-makers — all assuming they are able to access the website immediately on the date of disclosure.

Access to information must ensure those who need the information most are able to receive and understand it. Recognizing that is unrealistic for local communities to visit the IDB Invest website each day to see if any proposed project may affect them, the Early Warning System team is closing this gap by summarizing and distributing the proposed projects by IDB Invest and other development institutions to partners in country as soon as possible.

While IDB Invest’s current disclosure practice is already inadequate in providing communities with sufficient time to meaningfully engage, the new draft policy recommends decreasing the mandatory number of days for the environmental impact assessments of Category A projects to be disclosed before the Board date from 120 to 60 calendar days. Even less time is afforded for lower risk categories: Category C projects average 35 days, medium-risk financial intermediary (FI) investments average 51 days, and low-risk FI investments average 39 days.

We strongly recommend that communities be given as much time as possible to meaningfully engage in the proposal stage of a project, and that the information is made as accessible as possible to better enable their participation. Consider this: in our analysis, we found that only 20% of projects included information in a language other than English. Coupled with the complex terminology often used to describe projects, and the fact that the majority of communities affected by IDB Invest projects are not fluent in their national language (let alone English), can information disclosed only a few days before the Board date really be called “accessible”?

Proactive disclosure for financial intermediary subclients and subprojects

Finally, given ongoing civil society concerns around the opacity of financial intermediary lending, the above concerns apply for projects classified as financial intermediaries as well. The Tableau of our dataset below illustrates that nearly 40% of IDB Invest’s portfolio over the past year consists of financing provided to commercial banks, or other financial entities, for subsequent lending to sub-projects. In situations like this where the investing arrangement is already opaque, the Bank should take proactive measures to ensure that communities are informed that IDB Invest may be a financier for subprojects undertaken by their financial clients. As a start, IDB Invest should make the disclosure of all subclients and subprojects a condition of receiving funding from the Bank. Where national laws prohibit disclosure of certain information, as much information as is legally allowed should be disclosed, with a note explaining why the information was withheld.

Explore IDB Invest’s projects by country, sector, risk category, and disclosure period using this interactive map, available here: bit.ly/idbinvest

Policy loopholes circumvent information disclosure

IDB Invest, in response to the findings of our last analysis which highlighted significant gaps in disclosure, claimed that its current environmental and social policies do not require preparation or disclosure of certain documents where the risk category does not rise to a level of high risk. Regardless of the Bank’s assigned risk category, communities have the right to be informed about projects that will affect their lives. At minimum, the information we have highlighted above should be produced and disclosed with sufficient time prior to the Board date, regardless of risk categorization.

Looking Forward

IDB Invest operates in a region where it is often deadly for communities to voice their concerns about projects, or even request access to information. This makes the Bank’s information disclosure policies and practice even more important — given the rapidly shrinking space for civil society, IDB Invest must do more to meaningfully fulfill communities’ right to safe, timely and accessible information, early in the project cycle.

We hope that IDB Invest will use the opportunity afforded by the public consultations on its draft Access to Information Policy to strengthen its disclosure practices, so that they better prioritize communities, the intended beneficiaries of development.

Note: The Early Warning System team strives to ensure the accuracy of the data. This analysis was shared with the IDB Invest before publication to allow opportunity for comment. While the Early Warning System team has made every attempt to research and present data accurately, it is often difficult to guarantee the complete accuracy of certain projects due to the lack of regularity and transparency in how various development institutions record and publish information. Where there is a lack of clarity in the information (for example, when proposed project financing involves a range and is not subsequently confirmed by bank documents) the team has represented the information cautiously, resulting in a probable underestimation of the true amounts of finance. The Early Warning System team is committed to correcting any identified errors at the earliest opportunity.